Passive Simplicity. Active Results.

Diversification-Weighted Investing—Harness Volatility for Opportunity

Built to Challenge the Ordinary

Intech S&P ETFs aren’t just investments—they’re engineered to make passive exposure more purposeful. They combine the simplicity of passive indexing with the return potential of active strategies-without the high fees of traditional active management.

Harness Volatility to Optimize Index Exposure

Intech ETFs embrace what others fear—volatility—to enhance index diversification and mitigate over-reliance on stocks, sectors or factors, all while staying aligned with trusted S&P® indexes.

Pursue Returns Beyond Stock Selection

Many ETFs focus on stock picks, overlooking the broader role of portfolio dynamics—how volatility and correlations shape returns. Intech ETFs blend stock and portfolio insights, seeking diversified alpha.

Unlock Uncorrelated Alpha Potential

Volatility is inevitable, so we use it with intent. To preserve optimized diversification, Intech ETFs systematically rebalance—seeking to turn natural price movements into distinctive results

What Makes Intech ETFs Different?

Watch how our volatility-driven design reshapes core equity investing—bridging the gap between passive and traditional active.

Intech’s investment philosophy is grounded in financial science. We view volatility as a critical source of insight, using it to inform diversification and systematic portfolio design.

Grounded in financial science

Systematic portfolio construction

Available through ETFs for all investors

Demonstrated History. Built for the Future.

Most ETFs start with an idea. This one starts with 20+ years of results. Since 2004, the lntech S&P Large Cap Diversified Alpha ETF strategy has seen it all-booms, busts, and bubbles. Through it all, it's turned volatility into an engine for compounding growth.

This isn’t guesswork. It’s financial science in action.

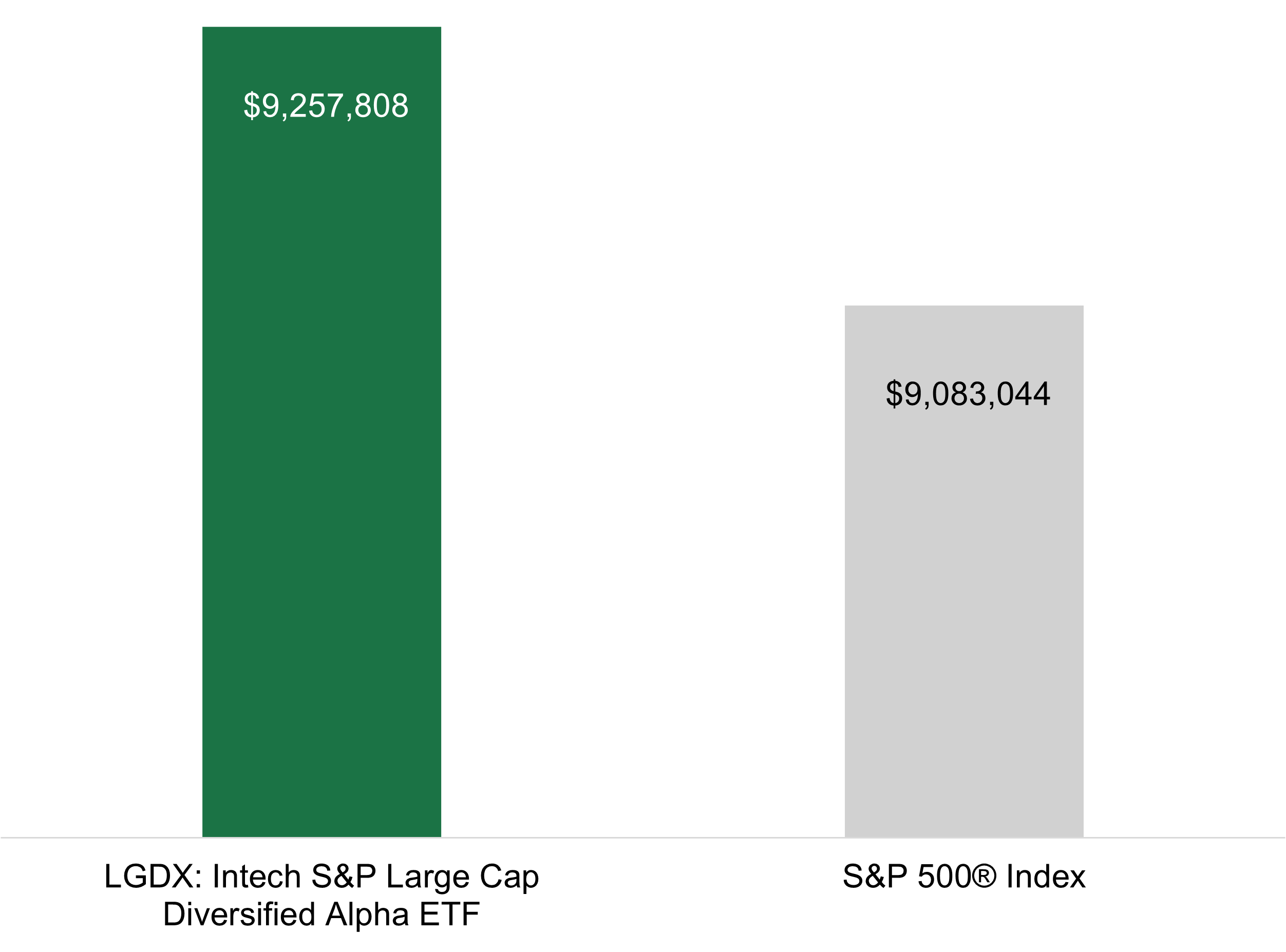

This chart illustrates the hypothetical growth of $1,000,000 if invested in the Intech S&P Large Cap Diversified Alpha ETF

strategy from 03/02/2004 to 12/31/2025 versus the S&P 500® during the same period. Before 02/28/2025, performance reflects a

predecessor fund and may not be directly comparable due to structural differences.

Intech S&P Large Cap Diversified Alpha ETF Performance

Inception: 03/01/2004. Performance before 02/28/2025 reflects a predecessor fund with a gross expense ratio of 0.375% vs 0.25% for the ETF. Returns would have been higher if the ETF’s lower expense ratio had been applied historically.

Performance before 02/28/2025 reflects a predecessor fund with a gross expense ratio of 0.375% vs 0.25% for the ETF. Returns would have been higher if the ETF’s lower expense ratio had been applied historically.

| Period | NAV | Price | Benchmark |

|---|---|---|---|

| 1 Year | 14.72% | 14.94% | 17.88% |

| 3 Years | 22.99% | 23.07% | 23.01% |

| 5 Years | 13.73% | 13.77% | 14.42% |

| 10 Years | 14.16% | 14.18% | 14.82% |

| Since Inception | 10.73% | 10.74% | 10.58% |

Disclosure

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance data, visit www.intechetfs.com or call 1-833-933-2083.

Before 02/28/2025, the bar chart and the performance table are for the Predecessor Fund. The Fund’s objectives, policies, guidelines, and restrictions are, in all material respects, equivalent to those of the Predecessor Fund. The Predecessor Fund is a private investment fund structured as a commingled vehicle under Section 3(c)(7) of the Investment Company Act of 1940. The Predecessor Fund is the only commingled vehicle in the Sub-Adviser’s composite of accounts managed with an investment objective and investment policies and restrictions materially equivalent to the Fund’s. The conversion of the Predecessor Fund into an exchange-traded fund (“ETF”) allows for operational and legal continuity for existing investors while enhancing the commingled structure with improved accessibility, tax efficiency, and lower fees.

The benchmark data reflects the performance of the S&P 500 Index. Indexes are unmanaged and do not reflect the deduction of fees, expenses, or taxes. It is not possible to invest directly in an index.

An investment in the Fund entails risk. The Fund may not achieve its investment objective, and you could lose some or all of your investment. Principal risks include equity market risk, general market risk, and risks associated with high portfolio turnover, among others. Please see the Prospectus for a full description of risks.

This information is provided for illustrative purposes only and should not be considered an offer to buy or sell any security. Please refer to the Fund’s prospectus for more complete information, including investment objectives, risks, charges, and expenses.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance data, visit www.intechetfs.com or call 1-833-933-2083.